The Customs Board (CBEC) has issued a notification on August 03, 2018 which states that commercial shipments < INR 5,00,000 is allowed through courier mode, using CSB V shipping bill. This would be applicable for all the Logistic Partners except for Aramex under eBay Global Shipping who are offering CSB V.

Aramex is currently accepting shipments < INR 25,000 and Weight < 25 Kgs.

Key Features:

- CSB-V mandates provision of GST details, IEC & HSN Code.

- Commercial exports using CSB-V are allowed from customs airports at Mumbai, Delhi, Chennai, Calcutta, Bangalore, Hyderabad, Ahmedabad, Jaipur, Trivandrum, Cochin, Coimbatore, Calicut, Tiruchirapalli and land customs stations other than at Gojadanga and Petrapole in West Bengal.

- Shipments going under CSB-V, can avail of MEIS benefits if they fall under the eligible category i.e. shipments of value up to INR 5,00,000 and involving transaction in foreign exchange.

Benefits:

-

Smooth Custom Clearance

-

GST Compliance

-

MEIS Claim

-

Less Paperwork

The key features and the benefits are subject to applicable laws of India including Courier Imports and Exports (Clearance) Regulations, 1998, Central Goods and Services Tax Act, 2017

and the relevant rules, regulations and state legislation on Goods and Services Tax.

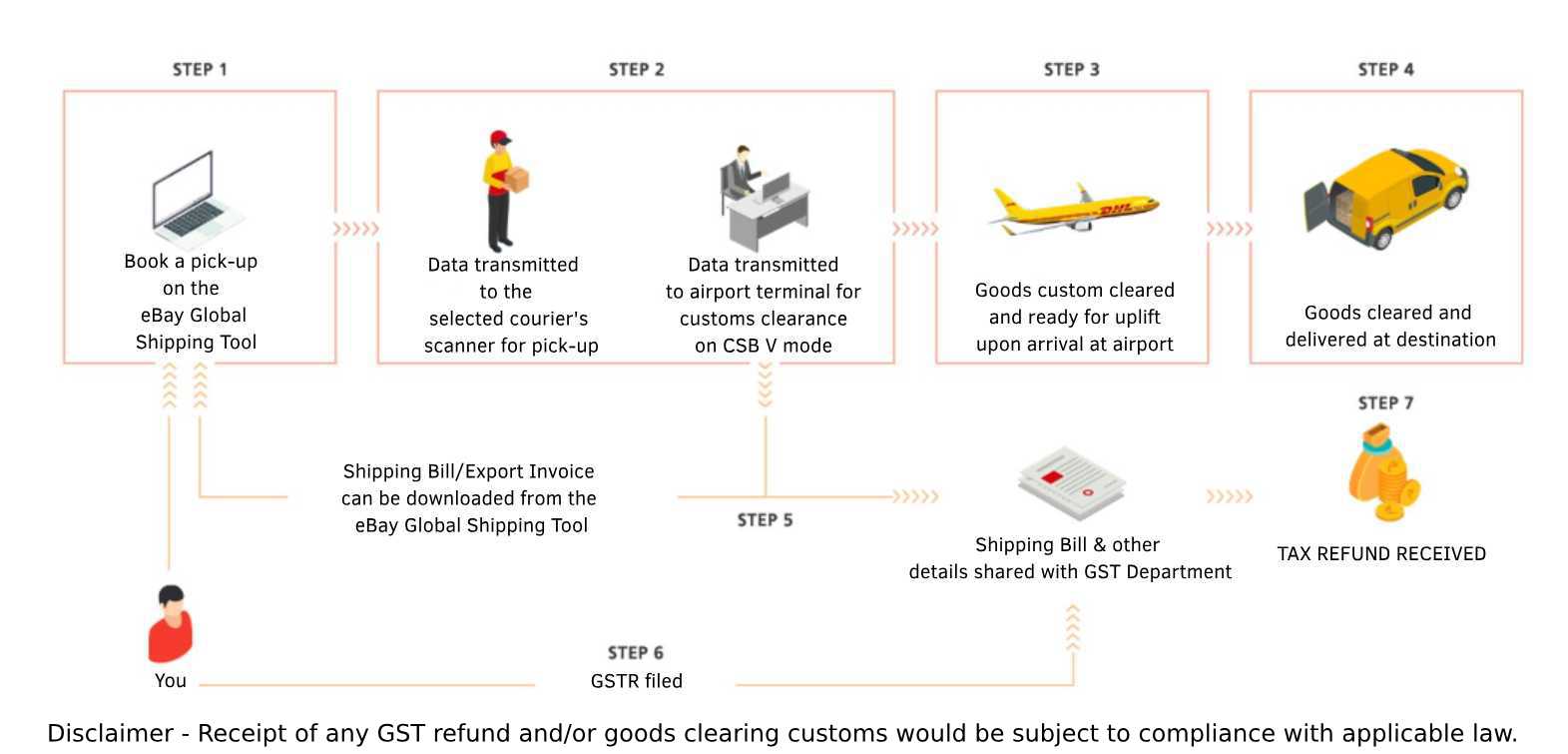

CSB V Export process flow: